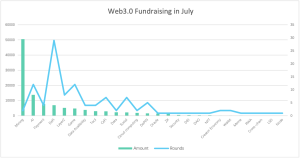

In July 2024, Web3 related projects secured a total of 113 funding rounds, with the total amount raised exceeding $1.1 billion USD, almost equals to the monthly average of the first half of the year. However, compared to July of the previous year, both the funding amount and the number of rounds has significantly increased. In fact, since last November, the overall fundraising environment for the Web3.0 market has notably improved, maintaining a relatively stable state this year.

Data resource: https://www.rootdata.com/dashboard

Mining, AI, DeFi, and Payment are Noteworthy Track

For the categories, although the mining sector only had two rounds of funding, the amounts were far ahead, which includes 413 million USD for Iris Energy and 92.5 million USD for Block Mining, the two largest deals in July. The AI sector ranked second in total funding, with 12 related projects raising a total of 138 million USD, benefiting from the AI boom this year. Following closely were the payment and DeFi sectors (sectors with overlapping areas were categorized based on their main business). DeFi, which is crucial for the liquidity of Web3.0 assets, has always been a popular field. And payment, as the bridge connecting Web3.0 assets with real-world assets, has also consistently garnered attention.

Data resource: https://www.rootdata.com/dashboard

Major Fundraising Projects

Iris Energy

$413 million, Mining

A company focused on renewable energy-driven Bitcoin mining. It uses renewable energy sources like hydropower for Bitcoin mining, aiming to achieve a more environmentally friendly and sustainable mining model.

Block Mining

Acquisition, $92.5 million, Mining

Primarily provides cryptocurrency mining services. The company is dedicated to offering efficient, secure, and reliable mining solutions, covering multiple mainstream cryptocurrencies.

Sentient

Seed Round, $85 million, AI

An AI&.ML company focused on developing advanced AI algorithms and solutions. The company aims to enhance enterprise efficiency and decision-making capabilities through intelligent technology.

Partior

Series B, $60 million, Payments

A blockchain-based financial transaction platform designed to provide efficient, secure, and transparent financial services, simplifying and accelerating cross-border payments and settlement processes.

B3

Seed Round, $21 million, Gaming

Dedicated to providing gamers with a simple, smoothy entry into blockchain gaming world. It aims to be a one-stop shop for game developers, offering infrastructure and helping with marketing and distribution so developers can focus on creating fun games.

Allium

Series A, $16.5 million, Data

Visa’s data partner, providing on-chain data infrastructure products, including hosted blockchain databases, rich data models, and real-time alert features.

Lombard

Seed Round, $16 million, DeFi

Lombard releases the liquidity of BTC by issuing liquidity and yield-bearing staked Bitcoin tokens, LBTC. LBTC is a yield-bearing, cross-chain liquid Bitcoin backed 1:1 by Bitcoin. LBTC allows Bitcoin to be used for earning yields, staking, trading, and large-scale participation in DeFi while still acting as a store of value.

Caldera

Series A, $15 million, Layer 2

One of the fastest-growing rollup ecosystems on Ethereum, focusing on providing high-performance, customizable application rollup solutions for Web3.0 teams. Its network supports an ecosystem of over 50 rollups and 1.7 million wallets, enhancing the efficiency, scalability, and security of rollups through shared network effects.

Chainbase

Series A, $15 million, Data

A blockchain infrastructure provider dedicated to offering high-performance and secure blockchain solutions. The company’s business includes decentralized databases, smart contracts, and blockchain application development.

ZAP

$15 million, Tools

ZAP is a Blast-based, community-driven token offering protocol designed to optimize token offering success rates by providing advanced technical support. It integrates the three services of ZAP Labs, ZAP Launch and ZAP Drops to achieve fair and efficient token allocation and community rewards through task control, fair allocation and risk protection.

RedStone

Series A, $15 million, Oracle

A cross-chain data oracle technology that provides fast, cost-efficient access to data, a full historic audit trail, and an insurance-backed decentralized dispute mechanism. It gives users recourse in the event of inaccurate data provision. The project uses Arweave blockchain to store data and track reputation.

Prodia

Seed Round, $15 million, Cloud Computing

A distributed cloud computing company building a distributed GPU network to provide more efficient cloud computing services at lower costs using web3.0 infrastructure.