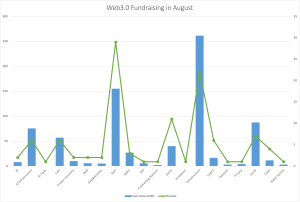

In August 2024, Web3.0 projects completed a total of 117 financing rounds, raising approximately $777 million, which is lower than the monthly average over the past year (around $867 million, shown by the blue line in the chart below). The market experienced significant fluctuations in August, and the capital market was also affected. However, the situation is still better compared to the same period last year.

Defi &. Infrastructure Were the Hottest Investment Tracks in August

Web3 infrastructure, including AI infrastructure, raised approximately $337 million in August, topping both the number of investment rounds and the total investment amount. DeFi still remained popular, with the same number of investment rounds as infrastructure (28 rounds). However, since many of the rounds were early-stage (seed or pre-seed), the total raised was not that high, though it still exceeded $155 million. Some notable projects worthy to watch include Morpho, Essential, Vessel, and Satlayer.

The social track also performed well in August, with the largest financing round ($80 million) coming from Story Protocol in this category. Another project, Myco, also raised $10 million. If we include the five undisclosed rounds, the total for this track would surpass $100 million.

Additionally, the AI sector continued to thrive, with AI-related projects, including AI tools and infrastructure, raising nearly $100 million in total. Edge Matrix Chain and Sahara are two projects to keep an eye on for future developments.

Major Fundraising Projects

Story Protocol

B rounds,80M,Social

Story Protocol provides a streamlined framework to manage the entire lifecycle of IP development, enabling features like provenance tracking, frictionless licensing and revenue sharing. Made for creators across all media – prose, images, gaming, audio and more – applications built on Story Protocol give writers and artists the ability to track their work’s provenance, allowing anyone to contribute and remix while capturing the value of their contributions.

Bridge

$58M, Infrastructure

Bridge is building a stablecoin-powered money movement platform, offering services such as payouts, cross-border payments and exchanging foreign currencies. its Orchestration and Issuance APIs make it possible for any company and team to offer digital dollar-based services to their end consumers or businesses.

Chaos Labs

A round, $55M, Infrastructure

Chaos Labs is an automated economic security system for crypto protocols that uses state-of-the-art monitoring and simulations. The company’s goal is to increase crypto adoption by providing protocols with custom and automated economic security tools that verify a protocol’s durability and stability in any market condition. Chaos Labs’ tools enable core teams and community members to monitor protocol health and risks in real time, so they can make mainnet changes before a potential vulnerability is exploited.

Morpho

$50M, DeFi

Morpho is a lending protocol that combines the liquidity pool model used by Compound or AAVE with the capital efficiency of peer-to-peer matching engines used in order books. Morpho-Compound improves Compound by providing the same user experience, liquidity, and liquidation parameters, but with an increased APY due to peer-to-peer matchings.

Sahara

A round, $43M,AI infrastructure

Sahara is a decentralized AI network that enables the creation of customized, autonomous Knowledge Agent (Sahara KA) for individuals and businesses. By utilizing this decentralized network, everyone can leverage their knowledge capital to explore monetization and automation opportunities through AI. The first launched Sahara KA is an AI that can autonomously analyze both external and internal proprietary data to offer reliable decision-making tailored to specific needs besides conversational capabilities. And Sahara Data provides high-value data services for AI model training, addressing concerns about security and privacy in data handling.

Fabric Cryptography

A round, $33M, Infrastructure

Fabric Cryptography is a start-up company focusing on developing advanced crypto algorithm hardware, specially building special computer chips for Zero-knowledge proof technology.

WSPN

Seed round, $30M, CeFi

WSPN is a global digital payments company that provides transparent, fast, and efficient digital payment solutions leveraging the latest technological advancements of Distributed Ledger Technology (“DLT”). WUSD is a USD-pegged native digital token within the WSPN ecosystem.

Edge Matrix Chain

$20M, AI infrastructure

Edge Matrix Chain (EMC), a multi-chain AI infrastructure and a Future3 Campus incubator project, is designed to scale and support GPU compute for crypto AI projects while introducing a new DeFi asset class backed by tokenized real-world GPU resources.

Space and Time

A round, $20M, Infrastructure

Space and Time is a Web3-native, decentralized data warehouse that enables low-latency queries and tamperproof analytics across Web3. DApps built on top of Space and Time become blockchain-interoperable, allowing them to process SQL and machine learning for Gaming/DeFi data, as well as any other decentralized applications that require verifiable tamperproofing, blockchain security, or enterprise-level scalability.

DAWN

$18M, DePin

DAWN is a decentralized wireless network for delivering Internet service. Through the protocol and hardware, property owners or residents have the opportunity to buy and sell Internet capacity in the area around them – empowering users to operate as their own Internet provider. The decentralized nature of DAWN facilitates a trustless system of exchange that employs proof of backhaul, location, and frequency.

Sling Money

A round, $15M, Infrastructure

Sling is an app where people everywhere can easily send digital cash to anyone, anywhere, for free. The funds held in your Sling Wallet are held in USDP, which is a digital currency issued by a company called Paxos Trust Company LLC.